In 2008, Satoshi Nakamoto published a paper on the Internet introducing a peer-to-peer electronic asset system, or Bitcoin, which used blockchain to record the

What is Cryptocurrency?

All Started from Bitcoin

(Note: As crypto asset does not have the characteristics of currency, the Hong Kong Government regards it as “crypto asset” or “virtual asset”.)

In 2008, Satoshi Nakamoto published a paper on the Internet introducing a peer-to-peer electronic asset system, or Bitcoin, which used blockchain to record the transactions. The system debuted in 2009 and became the world’s first decentralized crypto asset. The system operates without any bank or intermediary.

In May 2010, a US male spent 10,000 bitcoins to buy two pizzas. This was the first Bitcoin transaction in the physical world ever.

Other crypto assets emerged followed by the success of Bitcoin. As in Feb 2022, there are over 17,000 types of crypto asset actively circulated in the world, the most popular being Bitcoin, Ether, Tether (also known as USDT).

Until now, there have been doubts about the identity of Satoshi Nakamoto. Some suggest he is a Japanese, some says it is the code name of an organization.

Why is it called "crypto asset''?

Crypto asset is a form of virtual asset. It needs to be attached to a crypto asset address and cannot exist in a physical form. The physical Bitcoin seen on TV or on the Internet is just an “imaginary” image.

As the name suggests, crypto asset uses cryptographic principles to secure the integrity and control the transaction. It is operated by computers voluntarily connected to the crypto asset network. Crypto asset generally uses blockchain technology to create a decentralized open ledger to record transactions, so that crypto asset can circulate on the Internet. The transaction records are open to public, so that everyone can view the records in the blockchain (such as the blockchain.com website).

Basic elements of crypto asset

Blockchain

It is a public ledger that stores all transaction records, stored in data blocks connected to form a chain of blocks, i.e. blockchain. Taking Bitcoin as an example, the capacity of each block is around 1MB. The system creates one block of transaction records every 10 minutes and attaches them to the end of the existing blockchain. The transaction information recorded on the blockchain includes (i) the payer’s crypto asset address, (ii) the payee’s crypto asset address, (iii) transaction date and time, (iv) transaction amount, and (v) transaction ID. Once data is written into the blockchain, it cannot be modified or deleted. The blockchain does not keep any information to identify any party of the transaction, such as IP address, name of the payer or payee, etc. Therefore, transaction via crypto asset is highly anonymous.

Crypto asset address

It is like bank account number or mailing address, which is publicly displayed for receiving money or mail. The address is an encrypted public key randomly generated according to a specific mathematical formula. The key combination includes a public key and a private key, composing of digits and English alphabets. The key combination can be generated from different public sources (i.e. http://walletgenerator.net). Application or registration on platform are not required to get the address.

Private key

It is like a mailbox key, and its holder owns the crypto asset stored in the relevant address. In other words, the private key holder can transfer the crypto asset to another address. There is only one corresponding private key for each address. Due to the large number of private key combinations, even with the computing power of a supercomputer, it may take hundreds of years to crack the private key of an address. Once the private key is lost, the crypto asset of the relevant address cannot be retrieved. If you disclose your private key details, your crypto asset can be stolen.

Wallet

It is like a key case. A wallet can store multiple crypto asset addresses and private keys. The wallet can exist in the form of software or hardware, and is generally protected by a password. Software wallets usually contain software for sending crypto asset. Holder of wallet can transfer the crypto assets into another address. Each address only has one corresponding private key. Given the huge number of private key combination, it may take supercomputer hundreds of years to crack the private key, not to say an ordinary computer.

What is "mining"?

Computers (also known as “nodes” or “miners”) connected to the Bitcoin network record the blockchain and verify the transaction records. In the process of verification those records, the fastest node (or “mining pool”) solving the cryptographic problem set by the system will be rewarded with crypto asset. This process is called “mining”. The reward includes the newly generated crypto asset and transaction fees involved.

In order to prevent excessive mining, the system limits the maximum number of Bitcoin to 21 million. The system also has a halving mechanism, reducing the rewards to miners by half every four years. As such, all Bitcoins may be mined by year 2140 and miners can only rely on collecting transaction fees as a reward afterwards.

How to buy and sell crypto asset

There are different platforms for buying and selling crypto assets online. There are three ways to buy crypto assets in Hong Kong:

Crypto asset ATM machine

The buyer only needs to enter the crypto asset address at the ATM machine or scanning the QR code, and insert cash. The corresponding crypto asset will be instantly stored at that address and no registration is required. To convert crypto asset into cash, the user only needs to enter the private key and the sale amount, and the cash can be withdrawn, while such crypto asset will be transferred to the address of the ATM machine operator.

Crypto asset exchange platform

Opening an account on a Hong Kong based exchange platform generally requires identification documents, proof of address, bank account and other information. Registered users need to log in to the platform to buy and sell crypto assets.

Over-the-counter trading platform

It includes customer-to-customer (C2C) platforms, such as auction sites or online forums, other than crypto asset exchanges or ATM machines. The price, payment and delivery methods of crypto asset are set by the buyer and seller.

Related crimes and investment risks

Crypto asset related crimes:

Collect criminal proceeds with crypto asset

Since neither personal data or IP addresses of both parties in the crypto asset transaction will be recorded in the blockchain, it has extremely high anonymity. Many criminals used crypto asset instead of cash to hide their identities and undergo money laundering activities in criminal activities such as extortion, compensated dating, online love scams, etc.

Using crypto asset as an excuse to deceive

It includes online shopping fraud that criminals falsely claiming to sell crypto asset or mining machines, or investment fraud that criminals using fictitious crypto asset investment plans as bait.

Improper use of computers/hacking computers in mining

Criminals hack into computer systems to steal crypto asset, or inject malicious code to use others computers to mine.

The risks of investing in crypto assets:

Not regulated by law

Crypto asset is not a legal tender in Hong Kong and many countries, and investment in crypto asset is mostly unregulated. The crypto asset transactions in Hong Kong and overseas are inevitably lack of protection.

No intrinsic value

Crypto asset generally has no substantial basis, so its price volatility is huge. The cost of generating a new crypto asset is extremely low (nearly zero cost!), and creating a new coin only required 10 minutes, plus there are plenty of online tutorials on that. In the past years, there has been an “initial coin offering” (ICO) boom, that promoters use the issuance of crypto asset to crowdfund, while investors expect the profit will be reflected in the crypto asset price. The investment valuation is with low transparency and has no legal protection for investors, so it is extremely risky.

Easily fall into an investment trap

Fraudsters target investors, who do not fully understand the mechanism of the crypto assets, and use selling “cloud mining machines” or investing crypto asset to trick them. Investors spend huge amount of money or transfer crypto assets to fraudsters for such investment. Upon setting up an account, the platform will stop operation, show sudden system failure, or the return on investment is extremely low such that the investor could hardly have the cash back.

Stablecoin: USDT

In 2021, the Hong Kong Police Force has received 438 reports relating to investment frauds involving Tether (also known as USDT), accounting for 47% of crypto asset related investment frauds and involving losses of up to HK$300 million. There are several reasons attributed to the rise of USDT in fraud cases.

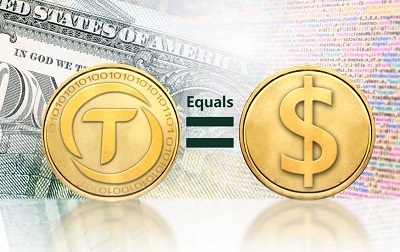

Claiming to be the first “Stablecoin” in the market

In 2014, USDT, which claimed to be pegged to the U.S. dollar, emerged as the first “Stablecoin” in the market. As the name implies, each USTD is theoretically guaranteed by one US dollar (analogous to the pegged exchange rate between HKD and USD), giving it an intrinsic value that reduces price volatility. Owners of USDT May feel like having the electronic version of US dollar. USDT has been touted as the “currency of the future”, and with over US$60 billion since issuance, the coin has been a huge hit.

The price of USDT has been hovering around $1 USD, with a daily volatility of about 0.05%, making it unattractive for short term investors. However, many trading platforms introduced USDT investment plans with stable return. They offer USDT buyers an interest rate ranging from 7% to 10% per annum, so as to attract people who are looking for a stable interest rate.

If the price is “stable”, why is it well-liked by investors?

Fraudsters using fake website as cover-up

Some fraudsters use high interest rates and low risk as excuses to attract investors who are pursuing stability to invest large amounts of money in time deposits. After the investors deposit their principal into the bank account designated by the fraudsters, some fraudsters lose contact with the investors, while others create fake websites or mobile applications to allow investors to log in to the “platform” to monitor their investment portfolios that never existed and continue to increase their bets until the moment the investors ask for cash. By then they will be surprised that their accounts are frozen or the platform is no longer accessible.

According to public information, the issuer of USDT is registered in the British Virgin Islands in which the actual operating address remains uncertain. Since it is not registered as a financial institution in Hong Kong, it is difficult to ascertain its financial information, operation records and license information. As to whether USDT has US$60 billion as guarantee, only the issuer knows best. If the issuer closes down one day, will USDT continue to circulate in the market? If investors suffer losses, how will they be able to recover?

Virtual assets involve high risk. Fully understand the product before investing to avoid being scammed.

Where does the guarantee come from?

Reference:

- 《虛擬資產與貨幣》, HKMA, 2018 (Chinese only)

- Discussion Paper on Crypto-assets and Stablecoins, HKMA, 2022

- Public Consultation on Legislative Proposals to Enhance Anti-Money Laundering and Counter-Terrorist Financing Regulation in Hong Kong - Consultation Conclusions, Financial Services and the Treasury Bureau, 2021

- Virtual Currencies Key Definitions and Potential AML/CFT Risks, Financial Action Task Force, 2014

- Coin Market Cap

- Faster Payment System

- Faster Payment System – Full list of Participants

You may be interested in

Artificial Intelligence (AI in abbreviation) is a technique of machine imitating human intelligence. In the 50’s, there were scientists suggesting…

The Hong Kong Monetary Authority (HKMA) unveiled “Fintech 2025” in the mid-2021, which aims to encourage the financial sector to…

The Internet reaches almost everywhere and contains massive source of information. How much information is accessible to the public? From…

In the digital age, teenagers have started to use the Internet since their childhood. Online content varies greatly. To what…

Some members of public might raise suspicion when receiving SMS messages from the government departments with a prefix +852 in…

Welcome to the metaverse journeyThe concept of the Metaverse originates from Snow Crash, a science fiction novel published in 1992…

NFT is a new form of virtual asset investment. Common NFT includes digital image, audio-visual file and video clip which…

The “HTTP 404” or “Not Found” page is a standard response message of HTTP status code, and it is also…

Deepfake (a portmanteau of “deep learning” and “fake”) refers to a technique using deep learning (an artificial intelligence Deepfake Deepfake…

In this era of information explosion, we are exposed to a wide variety of online media In this era of…

With the mature development of the mobile technology and cloud computing technology Digital Currency & Mobile Payment With the mature…

Cookie is a file stored in your computer or mobile, allowing the server to identify your device. What is Cookie?…

Many websites and mobile applications would collect your personal information and preference to provide more personalised experience and services, also…

Misinformation refers to false information, which is deliberately created and spread to cause harm to individuals or the society. Such…

Internet of things (IoT) has been defined as a global infrastructure for the information society, enabling advanced services by interconnecting…